and down comes the real rate of wage increases.

Any relation?

In early Q4 2007, the National Bank of Serbia’s key policy rate stood at 9.75% p.a. By the end of October it was lowered to 9.50%, only to be revised up to 10% at the MPC session of 27 December in order to put growing inflationary pressures under control. Interest rate on six-month NBS securities sold in outright auctions ranged from 9.85% (October auction) to 9.69% p.a. (December auction), which points to its continued downward trend. This rate is currently below the level of the key policy rate but is expected to go up over the coming period. Any other scenario would mean that financial market participants are expecting a decline of inflation and/or a more expansive monetary policy stance, the latter being highly unlikely in view of current developments.

In Q4 2007, the dinar appreciated by 1.6% against the euro and moved around RSD 78.8. And while in October the dinar appreciated steadily against the euro to reach its record high since November 2004 (RSD/EUR 76.8), November and December saw far more volatile exchange rate movements and, contrary to seasonal expectations, two episodes of sharp depreciation. The appreciation of the dinar resulted from high foreign exchange inflow and intensified demand for dinars following an announcement of another round of privatization. On the other hand, sharp weakening of the dinar in late November and early December can be attributed primarily to the effects of global developments and psychological factors, while the depreciation in late December was triggered by the mismatch in foreign exchange supply and demand.

During the period under review, the ECB kept its policy rate unchanged while the FED decided on two cuts in its policy rate, by 25 basis points each. The U.S. dollar continued to depreciate against the euro, all the while running above the psychological limit of USD 1.40 for EUR 1. As consequence, the dinar appreciated against the U.S. dollar by as much as 7.11% in nominal terms. In view of the FED’s January policy rate cut by a hefty 75 basis points, such trend is likely to continue in the period ahead. In Q4, the dinar/euro exchange rate moved within a very broad band of RSD/EUR 76.81 to 84.75, with exceptionally high daily oscillations in November and December reaching as much as 3% on some occasions. End-of-period analysis of exchange rate movements reveals that the dinar depreciated by 0.5% against the euro and appreciated by 3.6% against the U.S. dollar. As these two currencies make up the basket of currencies for calculating the effective exchange rate, the nominal effective exchange rate for the dinar strengthened by 0.8% at the end of the period.

As a result of strengthening of the nominal effective exchange rate for the dinar and faster growth in domestic relative to foreign prices, the real effective exchange rate appreciated by 2.6% in Q4 (by 1.5% against the euro and by 6.4% against the U.S. dollar). In Q4, the volume of foreign exchange trading in the interbank foreign exchange market declined somewhat relative to Q3, hence suspending the quarterly growth trend prevailing in 2007. Although trading volumes hit their record high in November (around EUR 3.0 billion), towards the end of the month they fell to exceptionally low levels which, coupled with strong exchange rate fluctuations, prompted the National Bank to intervene in the interbank foreign exchange market (on 29 November) by selling EUR 4 million.

According to the European Bank for Reconstruction and Development (EBRD), financing costs in less developed countries of the former Soviet Union and the Balkans have risen from mid-2007 by far more than those in the advanced states of Central Europe (Czech Republic, Slovakia, Poland, even Hungary).

Since last June, the spread on five-year credit default swaps (measure of risk) has widened by 26 basis points for the Czech Republic and 44 basis points for Poland. However, in non EU countries, which are more vulnerable to external shocks due to their macroeconomic imbalances, the increase in spread on five-year credit default swaps is even higher and ranges from 104 basis points for Bulgaria to 218 basis points for Kazakhstan. In between are Serbia and Ukraine, with the increase of 151 basis points. EBRD forecasts an economic slowdown in the region in 2008 as a result of higher investment risk, but at the same time, its experts hold that this will benefit economies running large current account deficits (Baltic countries, Romania, Serbia and Bulgaria) and help ease their macroeconomic imbalances.

Countries which have been growing fastest are likely to experience a soft landing. EBRD experts argue that EU member states, despite significant macroeconomic imbalances, are less vulnerable to external shocks than those outside the European Union as investors are inclined to think that EU membership brings clear development perspectives and imposes financial discipline.

Identical conclusions are derived from the Emerging Market Bonds Index (EMBI) for six Central and East European countries. As indicated by the chart, the increase in EMBI spread is much higher for non-EU member states (except Bulgaria) than for the EU member countries. Besides, increase in the spread is higher for countries running high inflation and balance of payments deficits, i.e. countries more vulnerable to external shocks. The largest increase in the EMBI spread from June to January 2008 was recorded for Kazakhstan and Bulgaria (140%), followed by Serbia (118%) and Ukraine (106%). Far lower increase was recorded for more developed Central European countries and EU member states - Poland (67%) and Hungary (49%).

Current Account

The current account deficit hit its all-time high in Q4, as did its share in GDP (18.9%). Relative to Q4 2006, it widened by 58.4% as a result of a rising deficit on trade in goods and services (51.9%). The shares of the current account deficit and the deficit on trade in goods and services in GDP rose by 3.4 and 3.3 structural points, respectively. The deficit on trade in goods and services widened as exports growth slackened and growth in imports picked up.

The decline in the year-on-year growth rate of exports continued into Q4. Such slowdown in export dynamics after July 2007 resulted mainly from a drop in exports of cereals (due to drought and a temporary ban on exports), and non-ferrous metals and iron and steel (due to the autumn overhaul in US-Steel). The value of exports of these products decreased from a record level of EUR 176 million in July down to EUR 99 million in December. If movements in these three sections of the Standard International Trade Classification (SITC) are excluded from the calculation, the dynamics of export growth was stable at around 30%, in euro terms. Commodity exports in dollar terms hit record high levels (USD 2,515.8 million) in Q4, but declined on a quarter earlier in euro terms. This was the first time since 2002 that exports in Q4 did not rise on a quarter earlier.

The composition of exports underwent positive changes, as the share of machinery and transport equipment almost equalled that of food and live animals and miscellaneous manufactured articles, and is poised to become the second most significant section of exports in 2008 (after manufactured goods classified chiefly material).

Year-on-year growth in imports and the trade deficit was higher in the second half of the year, as rising domestic aggregate demand spilled over into higher imports. A combination of slow structural reforms, expansionary fiscal and tight monetary policies contributed to the widening of external imbalances. According to the assessment of the Executive Board the IMF (of 5 February 2008), fiscal policy is the main short-term macroeconomic tool available for reducing Serbia's external imbalances. Fiscal restraint will continue to be needed to contain excess demand pressures until the effects of structural reforms take hold to support monetary policy. Monetary authorities should while competitiveness concerns should be addressed through rather than exchange rate intervention.

Bank lending to the private sector in 2007 grew by a total of RSD 225 billion, which is twice as much as in 2006. In Q4, year-on-year growth in credits to the private sector gathered further momentum on Q3 – their end- 2007 growth rate reached 42.8% (around 30% in real terms) compared to 36% at end-Q3. Growth in household lending slackened. Lending to enterprises picked up as did their direct borrowing abroad. Declining lending rates and higher enterprise demand for credit were the key factors behind credit expansion in Q4.

Apparently the dynamics of lending remained broadly unchanged in Q4, and measures to limit the volume of general purpose credits seem to have managed only briefly to halt the expansion in lending to households. However, as roughly 70% of credits are foreign currency clause indexed, credit growth can in part also be attributed to the nominal depreciation of the dinar.8 Note that the relatively higher credit growth in the final quarter of the year is also seasonally induced.

In the period under review, the share of domestic credit in GDP rose by one percentage point to almost 31%, which is notably less than in other economies in transition (with the exception of Romania). Hence, what Serbia is currently experiencing is a catching up process rather than a credit boom. If, however, direct enterprise borrowing abroad of USD 11.3 billion is taken into calculation, the share of total credit in GDP is about 50%, which is again below the average for economies in transition.

The main sources of finance for bank lending growth in Q4 were foreign currency deposits of domestic nonbanking sectors accounting for over 32% of the bank balance sheet total. The contribution of foreign sources of funds declined relative to earlier quarters. No clear trend pattern seems obvious with respect to maturity structure of banks’ borrowing abroad.

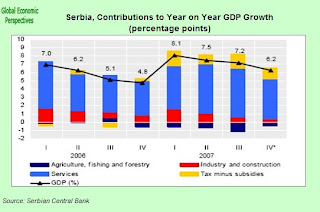

In its most recent report, the Serbian Bureau of Statistics presented revised GDP figures for the first two quarters of 2007. These data indicate that the slowdown trend continued into Q3 2007, which is consistent with our expectations presented in the November Inflation Report. Year-onyear, third-quarter real GDP growth was 7.2%, while non-agricultural value added10 increased by 9.0%. GDP was notably lower than non-agricultural value added due to the impact of exogenous factors which adversely affected agricultural production.

Gross value added contributed 5.5 pp to year-on-year GDP growth in Q3, while the contribution of taxes (less subsidies) was 1.7 pp. In the composition of gross value added, the largest contribution to year-onyear GDP growth came from the services sector, including in particular: transport activity (2.7 pp), retail and wholesale trade (1.7 pp), and financial intermediation (1.2 pp). GDP slackened mainly due to poor agricultural results, which negatively affected some branches of industry. The Q3 decline in agricultural production (8.7%, year-on-year) contributed 1.1 pp to the slowdown in GDP growth. In addition, a slower rise in real wages resulted in a moderation of aggregate demand which, in turn, led to the slackening of GDP growth.

As seasonally adjusted data indicate, GDP growth decelerated in Q4 (2.2% per annum) relative to 3.7% in a quarter earlier. The growth in non-agricultural value added was much slower (1.8%) than in Q3 (6.2%).

In Q4, industrial production increased by 0.4%, year-on-year, which is a notable moderation (3.2 pp) on a quarter earlier. Breakdown by sector reveals a slackening in production and distribution of electricity (4%, year-on-year), a mild decline in the processing industry and an appreciable drop in mining and quarrying (4.4%). Within processing industry, which accounts for the largest share of total industry (75.4%), production of non-metal minerals and basic metals, which contributed significantly to the September slowdown in production growth, continued on a declining path in December. Production of non-metal minerals declined by 9.3%, year-on-year, which is 3.1 pp higher than in a quarter earlier. As the production in this branch of industry is the main indicator of construction activity, the latter is estimated to have recorded similar movements.

Unable to recover from the sizeable decline in September induced by the autumn overhaul in US-Steel, the production of basic metals declined by 21.1% year-on-year, contributing negatively to growth in industrial production. Excluding the production of basic metals from the calculation, industrial production growth in the final two quarters is somewhat higher, but remains slowed down.

Based on selected indicators, the real growth rate of household demand is assessed at 3.8% in Q4 2007 relative to the comparable period a year earlier. Its decline on Q3 (10.7%) resulted from a decrease in the nominal growth rate (from 18% in Q3 to 13% in Q4) and the stepped up inflation. Sources of fourth-quarter growth in consumer demand were as follows: Wages. The ratio of net wages from the statistical sample to estimated GDP was 12.8%, which is 0.6 structural points up on the comparable period a year earlier. Assuming that employees not included in the sample earn on average as much as those included in the sample, the ratio of net wages to estimated GDP is 34.6% or 2.4 structural points more than in the comparable period a year earlier;

Social transfers. This category of household income accounted for 14.6% of the estimated GDP, which is 0.5 structural points less than in the same period in 2006;

Remittances. Registered remittances accounted for 4.4% of the estimated GDP, which is 0.2 structural points more than in Q4 2006; Exchange offices. Household income recorded through exchange transactions accounted for 3.4% of the estimated GDP, which is a decline by 0.3 structural points on Q4 2006;

Credits. Borrowing provided households with an additional source of financing consumption and amounted to 2.9% of the estimated GDP, which is an increase by 0.7 structural points on Q4 2006. Savings. Household savings increased by 7% of the estimated GDP, which is 3.2 structural points up on Q4 2006. In part, this increase was due to the depositing of mattress money triggered by competitive interest rates offered during the Savings Week early in November.

The ratio of household income (less increase in savings and plus increase in credits) to GDP declined by 0.5 structural points (to 52.9%). This decline and the increase in savings (not related with current income) indicate that household demand generated no inflationary pressures during Q4 2007.

Total consolidated revenue of the budget of the Republic of Serbia, grants excluded, reached RSD 281.3 billion in Q4 2007, which is up by 17.8% in nominal and 7.0% in real terms on a year earlier. Total consolidated expenditure came to RSD 333.4 billion, which is up by 18.0% in nominal and 7.2% in real terms on a year earlier (when budget spending was also exceptionally high). The resultant fourth-quarter fiscal deficit was RSD 52.1 billion (7.53% GDP).

The negative fiscal result stemmed from record high spending in almost all expenditure categories. Total expenditure thus rose in nominal terms by 31.1% in Q4 relative to Q3, and by a hefty 65.0% in December relative to November.

Persistent slowdown in industrial production, in place since Q2, led to a deceleration in productivity growth. As productivity gains fell behind growth in real gross wages, unit labour costs increased. This was particularly pronounced in the last quarter of 2007. Thus, unit labour costs in the industrial sector rose by 2.3% on the same period a year earlier. Slackening in the processing industry growth and the 3.1% rise in unit production costs in an environment of real appreciation of the dinar have had a negative impact on the competitiveness of domestic economy.

According to our estimates, total employment in December 2007 amounted to 2,441.2 thousand persons, which is a small decline from September. While employment plummeted in the majority of sectors in Q4, it rose in financial mediation, real estate business and part of the public sector (education and culture, healthcare and social work).

In the course of 2007, the sharpest drop in employment was recorded in the processing industry (down by around 24 thousand jobs), which is in line with the slackening of economic activity in this sector. Notable drop in employment was also recorded in the construction industry, mainly due to seasonal factors, as well as in the production of electricity and gas. The largest increase in employment was recorded in education, healthcare and social work, i.e. public sector. Employment also went up in trade, real estate business, financial mediation and transport. Decline in unemployment continued in Q4. Total unemployment amounted to 785.1 thousand in December, down by 23 thousand or 4.9% from September. This year’s drastic drop in unemployment by 131.1 thousand or 14.0% is largely attributable to the re-registration of around 90 thousand persons from the records of the National Employment Service to the records of the Republic Health Insurance Bureau. Positive movements were registered with the number of first-time job seekers, which equalled 328.7 thousand in December, 17.3% down on the same month a year earlier.

However, the share of first-time job seekers in total unemployment remains very high – 48.7%. The number of persons seeking employment for longer than two years was lower by 7.7% in December 2007 than in the same month a year earlier.

Other labour market indicators show that the estimated rate of unemployment equalled 24.3% in December, down by 2.4 pp from the same period a year earlier. New employment rose 5.6% year-on-year and reached 189.3 thousand in Q4. Of the new employment figure, 82.5 thousand persons from the records of the National Employment Service were first time employed (43.6%), while 106.7 thousand persons changed jobs (56.4%). On the other hand, year-on-year vacancy growth rate fell victim to economic slowdown and declined by 4.3 pp from Q3.

Serbia's central bank raised its benchmark two-week repurchase rate to 15.25 percent on April 24, and this was the fourth increase since the start of February, to ward off inflation.

The monetary board made the decision to lift the rate by three-quarters of a percentage point.

``The increased level of restrictiveness was necessary and it will contribute to the return of core inflation to 6 percent projected for 2008,'' central bank Governor Radovan Jelasic said. There are ``inflationary expectations that remain high and rising.''

Narodna Banka Srbije has lifted the main rate a combined 5.25 percentage points since Jan. 1 to stem accelerating price growth as authorities struggle to attract investors and align the economy, battered by civil war in the 1990s, closer to western Europe. The inflation rate has soared to 14.6 percent from 3.1 percent in May 2007 because of rising food and fuel costs.

The core inflation rate, which strips out state regulated prices, was 7 percent in March, 1 percentage point higher than the 2008 target.

April 2 (Bloomberg) -- Serbian central bank Governor Radovan Jelasic said he is prepared to spend the bank's reserves and raise interest rates to support the dinar before May 11 elections that may determine whether Serbia moves closer to the European Union.

The bank on March 13 lifted the two-week repurchase rate by 3 percentage points to 14.5 percent, the highest since December 2006, to strengthen the currency and reassure foreign investors.

``Two weeks ago we had a collapse of the government, a drop in the credit rating, an increase oil and agricultural product prices and accelerating inflation,'' said Jelasic, 40, in an interview in Belgrade on April 1. ``As we now have a caretaker government, we cannot count on their support in combating inflation in the next three to six months.''

Serbia, ravaged during the Balkan civil wars of the 1990s, is holding early elections after the Cabinet collapsed following the Feb. 17 declaration of independence by the mainly Albanian- populated Kosovo province. Investors are concerned pro-EU parties will lose to ultra-nationalists who've condemned the bloc for supporting Kosovo's breakaway.

The Serbian Radical Party and caretaker Prime Minister Vojislav Kostunica's Democratic Party of Serbia favor closer ties with Russia and reject Kosovo's independence and EU membership without Kosovo. Allies of President Boris Tadic want eventual EU membership to attract investors and strengthen the economy.

Available Reserves

Jelasic said the central bank has 9.6 billion euros ($15 billion) in available reserves to shore up the dinar, which lost as much as 1.5 percent against the euro following Kosovo's declaration. Since the March 13 rate increase, the currency has gained 2.5 percent.

A priority for Jelasic is containing inflation, which soared to 14.5 percent in February, more than four times the euro region inflation rate of 3.5 percent for March.

Standard & Poor's Ratings Service lowered its outlook for Serbia's credit rating to ``negative'' from ``stable.''

The bank can ``absorb political tremors,'' said Jelasic. ``In the long run, it would be much better if the political establishment could take more responsibility, not only in reforms but also in implementing price stability.''

Jelasic also expressed concern about the collapse of an agreement between the government and trade unions to keep real wage growth in line with the projected 6 percent inflation.

On March 31, the bank changed foreign currency reserve requirements to boost the use of the dinar. As of May 17, 10 percent of the mandatory 45 percent minimum deposit requirement for commercial banks will have to be in dinars.

``Most banks look at dealing with dinars as a nuisance, but the dinar is our national currency,'' he said. ``We expect that these measures will increase the dinar's share in bank balance sheets, show borrowing costs more realistically and boost dinar deposits in commercial banks

March 13 (Bloomberg) -- Serbia's central bank increased its benchmark two-week repurchase rate by 3 percentage points to 14.5 percent after the country's Cabinet collapsed and the president called new elections.

The bank last raised the rate three-quarters of a percentage points to 11.5 percent on Feb. 28, after the currency depreciated in the wake of violence associated with Kosovo's declaration of independence.

An ``immediate increase of monetary policy restrictiveness was inevitable'' so the central bank can meet its core inflation target of between 3 percent and 6 percent by the end of the year,'' the Belgrade-based bank said in a statement today.

Serbian President Boris Tadic dissolved the parliament today and announced early elections for May 11, following the government collapse on March 10.

The central bank said today the economy has worsened as the political problems intensified in recent weeks. Political instability and tensions that followed declaration of Kosovo's independence on Feb 17 is threatening to scare away investors, said Goran Nikolic, and analyst with the Serbia's Chamber of Commerce.

Serbia continues to grow strongly—a welcome result of the structural reforms of the past. Real GDP growth is projected to reach about 7 percent in 2007. Much has been done since 2000: inflation has come down significantly; the banking sector was restructured; and hundreds of companies were privatized. As a result, for the first time in years, the corporate sector posted aggregate profits.

IMF Executive Board Concludes 2007 Article IV Consultation with the Republic of Serbia

Public Information Notice (PIN) No. 08/11

February 5, 2008

The large inflows allowed for significant official reserve accumulation (7½ months of imports as of November 2007), but also led to a surge in demand. This was compounded by rapid credit growth and expansionary domestic policies—large wage increases in the public sector, income tax cuts, and fiscal deficits in 2006-07. Given domestic supply rigidities—and a drop in remittances—the current account deficit continued to widen, reaching 16½ percent of GDP in the period January-November 2007.

Expansionary fiscal policies contributed to the widening of external imbalances. Driven by rising expenditure, the fiscal balance has deteriorated by over 2½ percent of GDP since 2005. In 2006, the deficit reached 1½ percent of GDP—some 4 percentage points adrift of the target envisaged in February 2006 under the Extended Arrangement with the Fund. In 2007, a deficit of 1¾ percent of GDP is expected.

The volume of exports currently stands at only 27 percent of GDP—one of the lowest in the region—and just over half of the country’s imports. And the seemingly high growth of exports—which increased by over 8 percentage points of GDP since 2002—is still below average in Emerging Europe. Furthermore, Serbia’s exports represent over 40 percent of Serbia’s The high import content of exports further lowers the effective foreign exchange receipts.

The combination of high external deficits and export weaknesses make Serbia one of vulnerable economies in the region. In a sample of emerging European market economies, three countries — Bulgaria, Estonia and Latvia— current account deficits than that of Serbia). Unlike Serbia, however, countries are members of the EU and have export sectors that are several times larger than Serbia’s.

Gross official reserves have more than tripled since 2004, reaching USD 14 billion or 7.5 months of imports in 2007—the highest in the region. However, rapid reserve accumulation was partly a result of the prudential tightening and increased reserve requirements on commercial banks’ foreign exchange liabilities in 2006. This boosted commercial banks’ foreign currency deposits to about USD 5 billion. Because these deposits represent commercial banks’ obligations to the domestic and foreign private sectors, the central bank cannot fully rely on them in times of distress.

High credit euroization and significant external vulnerabilities suggest—even after controlling for low to GDP ratios—a lower debt-carrying capacity of Serbia’s households relative to neighbors. The share of forexdenominated and forex-indexed domestic credit exceeds 70 percent and is among the highest in emerging Europe (Figures 7 and exposing borrowers in Serbia to larger currency risks.

In addition, low exports, rapidly growing euroized liabilities in the corporate sector, and other external vulnerabilities discussed above are closely linked to the financial sector. In these circumstances, even moderate disturbances may eventually lead to changes in the household sector’s balance sheets and could quickly spill over to the rest of the economy. These considerations suggest that on balance, the current rapid growth of household credit is making the country more vulnerable, and that there is a need for reforms that could boost economic growth, thereby creating space for additional household borrowing and allowing consumption smoothing without jeopardizing sustainability.

Republic of Serbia - The Serbian diaspora in Switzerland is one of the largest foreign populations in the country. The migration of Serbian nationals to Switzerland is largely rooted in Swiss labour migration policies of the 1960s, 70s and 80s when short-term “guest worker” permits were offered to thousands of Serbian nationals.

Over the years, increasing economic hardship remained the key factor motivating Serbian men and women to migrate to Switzerland, and ultimately to remain there permanently. By the time the Swiss government phased out the seasonal guest-worker programme in the 1990s, a large Serbian population had established permanent residency in Switzerland, a status which allowed for family reunification, resulting in the present-day Serbian diaspora of approximately 200,000 people.

This labour migration has had both positive and negative effects on migrant sending households and communities in Serbia, according to a recently published IOM report.

On the one hand, migration to Switzerland has contributed to a significant depletion of the working-age population in many migrant-sending communities and has left behind many households mostly composed of children and elderly people who are increasingly unable of meeting their daily economic needs through traditional agricultural activities because of the absence of working-age relatives.

At the same time, the report clearly establishes that long-standing transnational relationships between these households and their migrant relatives in Switzerland have facilitated the flow of remittances and other forms of material support, which today play an important role in poverty alleviation, especially among older, rural households with low levels of education and an income of less than 1,000 Swiss francs per month.

Data collected by IOM among 343 households in Petrovac na Mlavi and Cuprija, two rural migrant-sending regions of Central and Eastern Serbia, finds that remittances sent by the Serbian diaspora in Switzerland contribute mainly to the acquisition of housing or are used to support recurring living costs and basic needs such as water, electricity, gas, food, medicine, healthcare and, to a lesser extent, children’s education. About 8 per cent of respondents said they invested part of their remittances in small to medium-sized enterprises.

At the micro-economic level, the impact of remittance flows to rural Serbia is confirmed by the fact that more than 90 per cent of the surveyed households receive remittances, which on average total CHF 4,800 per year. The report shows that households also receive goods such as household equipment, mobile phones and televisions, as well as machinery for agricultural activities.

Remittances, which can account for 40 per cent of household income, are mostly sent informally on a monthly basis. They are either hand-carried by migrants, friends or acquaintances or sent via a vast network of bus drivers who shuttle between Switzerland and Serbia on a daily basis.

According to the report, the use of informal channels can be explained by a lack of trust in Serbian financial institutions and by high remitting costs. To increase the flow of remittances through formal channels, the report underlines the need to reduce remitting costs. This could be done by setting up new partnerships between financial service providers in Switzerland and Serbia, by improving banking provisions to bring more people into the formal banking system and by setting up special savings to encourage investments in small to medium-sized enterprises to create employment in Serbia and help the country retain its skilled young professionals.

Other measures, including new banking policies and financial legislation that allow expatriates to hold foreign currency accounts in Serbian banks could further encourage expatriates to invest remittances in enterprises that would benefit Serbia’s poorer regions.

No comments:

Post a Comment